Bringing structure and security to your business. You’ve worked hard to make your business a successful one.

Make sure it continues to be successful by planning for the unexpected.

Many businesses are not able to survive the death of an owner. What happens to the business when your unique skill is gone? What do your co-owners need to do to have the business survive your passing? What will happen to your family if you are no longer able to work in your business due to premature death – will they still be able to benefit from cash flow from your business? Many businesses are not prepared to survive following this event. Many families are not adequately protected. A business succession strategy using a properly structured buy-sell agreement can help you protect your family and the business you have worked so hard to create.

The death of a business owner or partner can be an uncertain time for the life of a business. A buy-sell agreement can help protect you and your business from the effects of unintended or unwelcome transfers of ownership. Surviving owners can purchase the deceased owner’s share of the business—without taking out a loan or giving up needed capital. It may also help protect your heirs, by giving them an opportunity to turn shares into cash. In addition, many consider it’s important to develop a plan to help surviving family members or owners fund the transfer of ownership of the business. By purchasing a life insurance policy to fund your buy-sell agreement, you can help protect and extend the life of your business.

From modest family operations to multi-billion-dollar corporations, the death of an owner can seriously cripple a business. A buy-sell life insurance agreement allows for a smooth transition in ownership to the surviving owners. Without a buy-sell agreement, the heirs of the deceased owner will inherit those shares of the company. They can then sell their shares of the business to anyone—which could force important decisions about how the company is run to be made by people outside of the surviving owners’ control. The heirs of the deceased might not want to be a part of the business. A buy-sell agreement allows the family of the deceased to turn their inherited interest in the business into cash—freeing them from the burden of taking on a role as an owner of the business. By planning ahead with a buy-sell agreement, you can avoid unnecessary hardship on both family and colleagues. Your business can continue to succeed in the future, and avoid lengthy probate court and lawsuits.

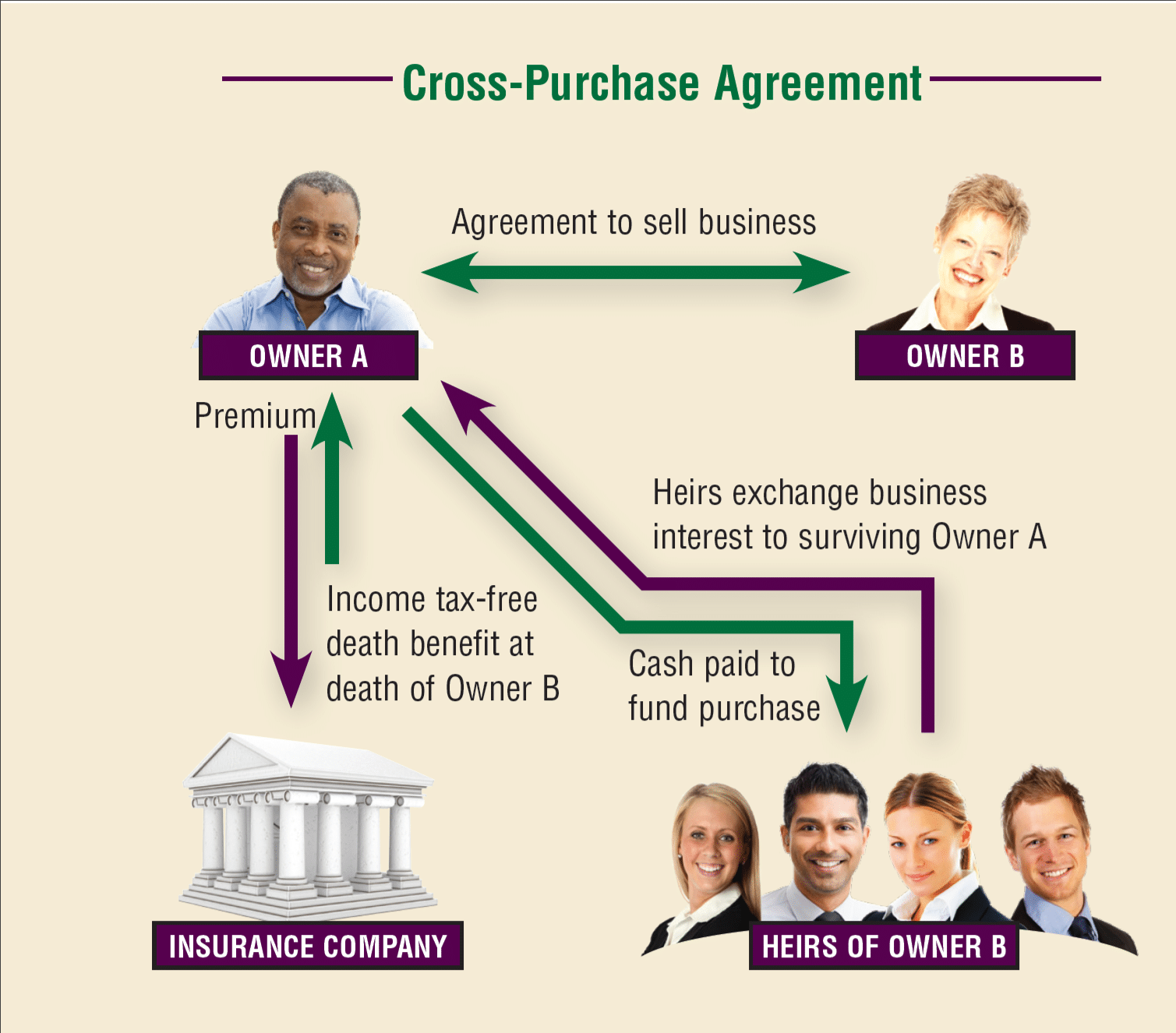

The co-owner(s) will buy the

business interest from the selling owner

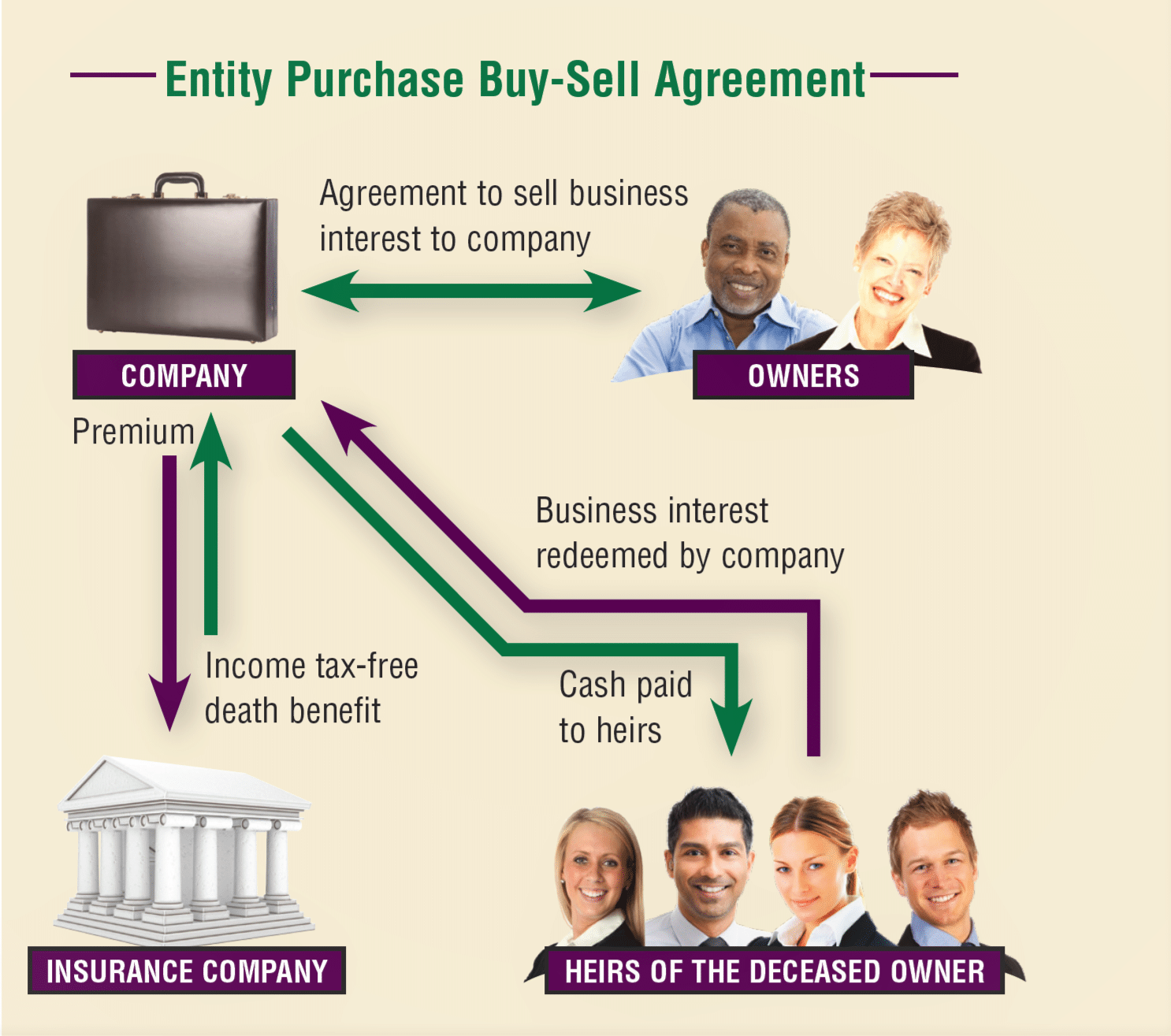

The business will purchase the

business interest from the selling owner.

Hybrid aka Wait and See

This is a hybrid agreement that mixes the entity purchase and the cross-purchase.

(Ask your agent for more details)

First, each owner must sign a legal contract, called the Buy-Sell Agreement. This is a formal document prepared by a lawyer, not an insurance agent, which obligates the surviving owners to buy the shares of the company from the heirs of the owner that passes away—essentially buying any heirs out of the business. Next, each owner pays for and is the beneficiary of life insurance on the other owners’ lives. Finally, upon the death of an owner, the surviving owner receives the life insurance death benefit payment and uses that money to buy the shares of the business now belonging to the deceased’s heirs.

First, the company and owners must sign a legally drafted Buy-Sell Agreement, which this time obligates the company to buy the shares of an owner upon death. Next, the company purchases its own and pay the premium on a life insurance policy for each of the owners. The company is named beneficiary of that life insurance policy. Upon the death of an insured owner, the company receives the death benefit payment, pays the deceased’s heirs, and transfers the business interest back to the company.

The choice between a Cross-Purchase Agreement, Entity Purchase Buy-Sell Agreement and Hybrid aka Wait and See Agreement will depend on the specific situation of the company, as there are advantages and disadvantages of each approach. A lawyer can help determine which arrangement is best for each specific situation.

Remember, having a business succession plan in place may allow for an orderly transfer of your business to the “right party” at the “right time” and will set your mind at ease. Don’t leave the future of your business to chance. Plan today for your business to survive if you were to experience a triggering event such as death. A Buy-Sell agreement should be a vital part of your business operating plan and your family’s financial security.

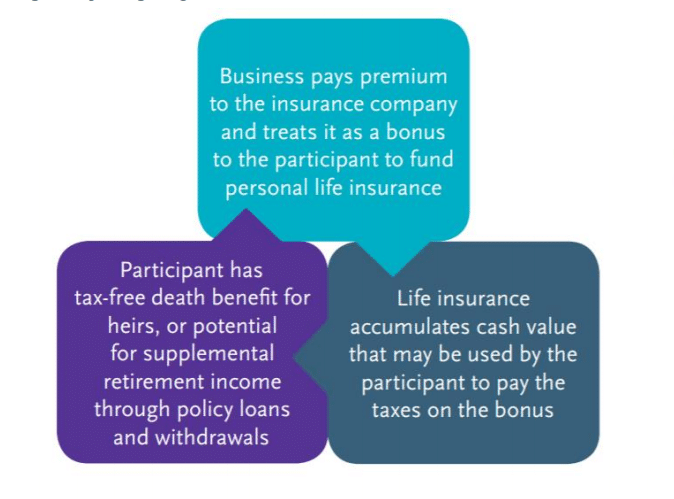

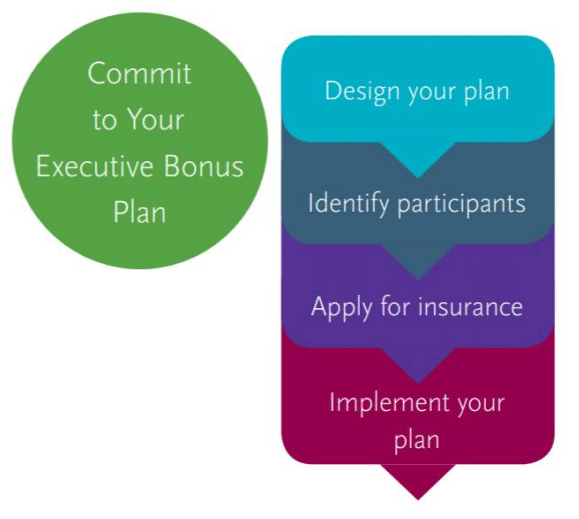

The impact of losing and replacing a key employee can be costly. Having a plan in place can help minimize the

effect that may have on your business upon an important employee’s premature death, serious illness, or

losing to a competitor. Key-person life insurance and Employee Executive bonus can keep your business running ahead of your competition.

Reward your key employees

Help contribute towards employee secure retirement

Provide death benefits to you or your employee’s family

Whether you own a large company or a small family-operated business, the success of your business depends on a smart strategy and planning. It’s important to protect your hard work. Buy-Sell agreement and Employee Executive bonus solutions can ensure that all the effort and money invested in the business won’t disappear when the unexpected happens.